Office Hours

Monday - Friday 9am - 5pm

Nights & Weekends by Appt

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Kyle Hale

Hale Ins and Fin Svcs Inc

Office Hours

Monday - Friday 9am - 5pm

Nights & Weekends by Appt

Address

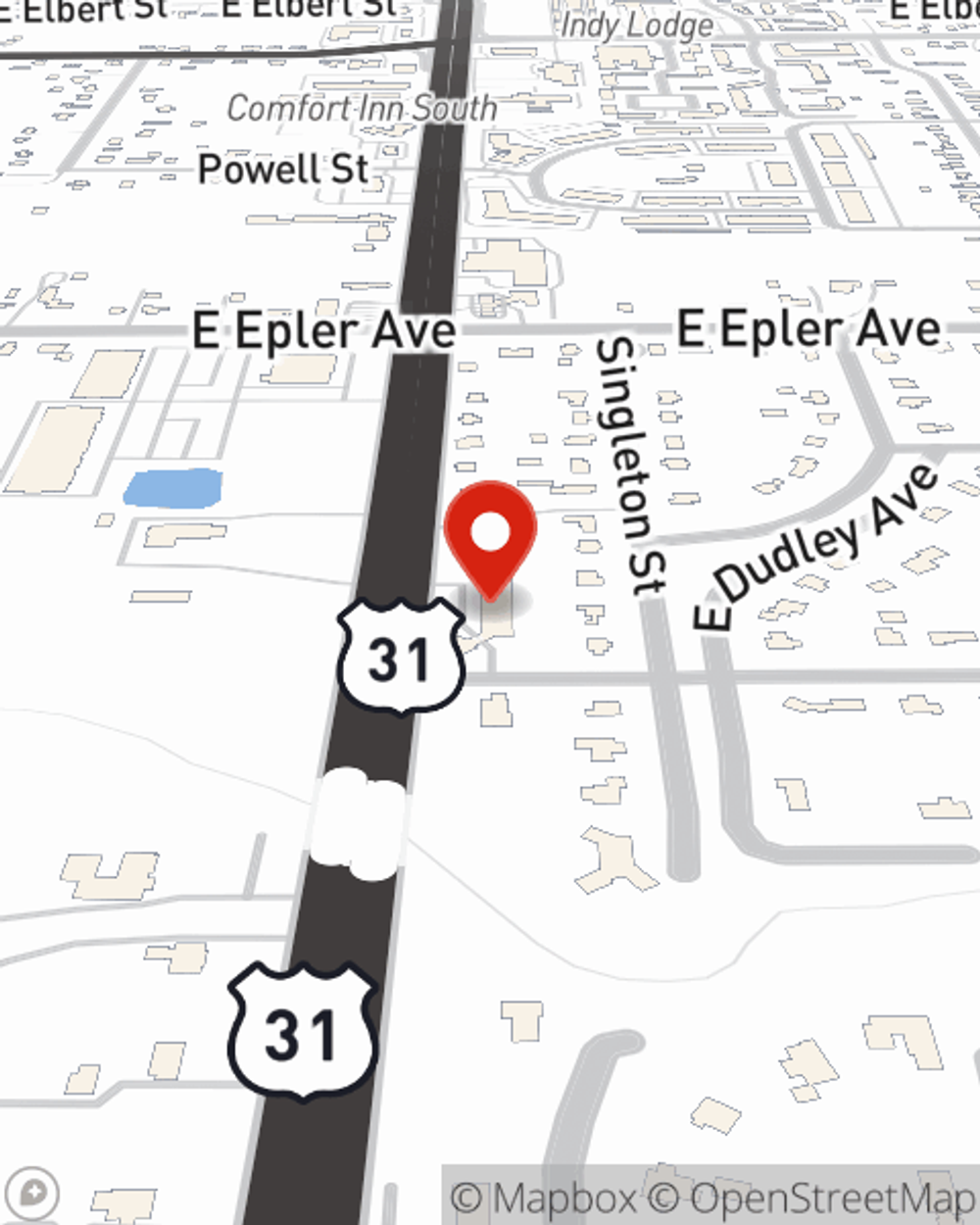

Indianapolis, IN 46227

We are at the corner of Gilbert Ave and US 31, North of Edgewood Ave, on the East side of the Road

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

Monday - Friday 9am - 5pm

Nights & Weekends by Appt

Contact me to schedule a virtual meeting

-

Phone

(317) 887-6858 -

Toll Free

(833) 733-7212

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Office Info

Office Info

Office Hours

Monday - Friday 9am - 5pm

Nights & Weekends by Appt

Contact me to schedule a virtual meeting

-

Phone

(317) 887-6858 -

Toll Free

(833) 733-7212

Languages

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Social Media

Viewing team member 1 of 2

Kaitlyn Spalding

Customer Service Manager

License #3171201

Our mission is to help people manage the risks of everyday life, recover from the unexpected and realize their dreams. In addition, our office strives to provide you with an understanding of the products and services State Farm offers while focusing on the needs of you and your family.

We are honored to help the customers of Indianapolis and throughout Indiana and Ohio, with all of their insurance and financial services needs.

We help in 46217, 46227, 46237, 46142, 46143, 46201, 46202, 46203, 46204, 46205, 46208, 46214, 46216, 46217, 46218, 46219, 46220, 46221, 46222, 46224, 46225, 46226, 46227, 46228, 46229, 46231, 46234, 46235, 46236, 46237, 46239, 46240, 46241, 46250, 46254, 46256, 46259, 46260, 46268, 4678, 46280, 46282, 46290, 46032, 46033, 46074, 46037, 46038, 46040, 46060, 46062, 46034, 46062, 46074, 46077, 46184, 46259, 46113, 46183, 46221, 46168, 46126, 46123, 46112, 46106, 46131, 46162

Viewing team member 2 of 2

Sam Claxton

Account Manager

License #4112785

I’m proud to support individuals and families in safeguarding what matters most to them, while building strong relationships and handling every situation with care.

Outside of work, I enjoy spending time with my family caring for my dogs and chickens and embracing the simple joys of everyday life. I bring the same dedication and heart to our customers as I do to the things I love most.

I am honored to help the customers of Indianapolis and throughout Indiana with all of their insurance and financial services needs. We help with in locations 46217, 46227, 46237, 46142, 46143, 46201, 46202, 46203, 46204, 46205, 46208, 46214, 46216, 46217, 46218, 46219, 46220, 46221, 46222, 46224, 46225, 46226, 46227, 46228, 46229, 46231, 46234, 46235, 46236, 46237, 46239, 46240, 46241, 46250, 46254, 46256, 46259, 46260, 46268, 4678, 46280, 46282, 46290, 46032, 46033, 46074, 46037, 46038, 46040, 46060, 46062, 46034, 46062, 46074, 46077, 46184, 46259, 46113, 46183, 46221, 46168, 46126, 46123, 46112, 46106, 46131, 46162