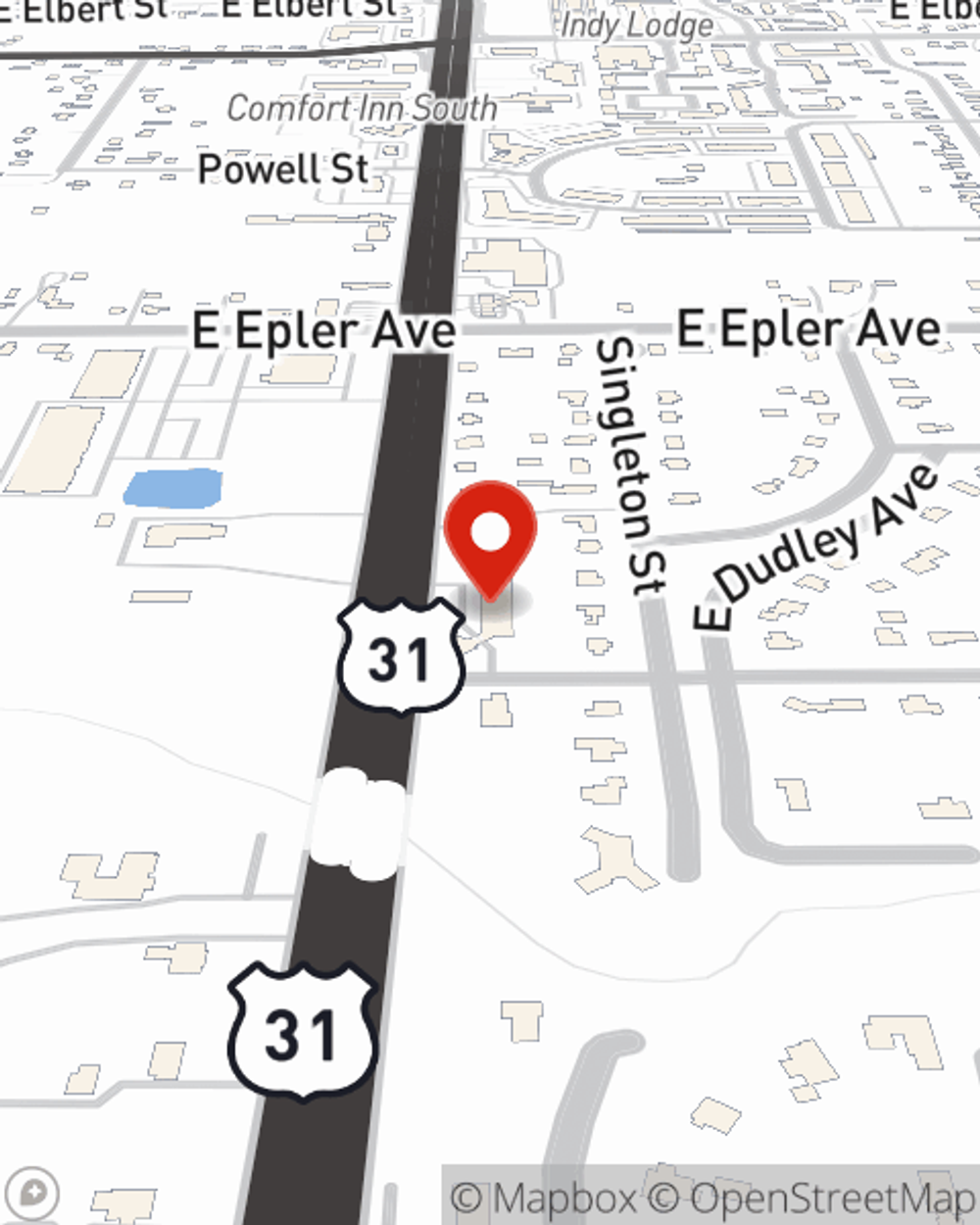

Business Insurance in and around Indianapolis

Looking for coverage for your business? Look no further than State Farm agent Kyle Hale!

This small business insurance is not risky

Help Protect Your Business With State Farm.

Running a business can be risky. It's always better to be prepared for the unfortunate problem, like a staff member getting hurt on your business's property.

Looking for coverage for your business? Look no further than State Farm agent Kyle Hale!

This small business insurance is not risky

Customizable Coverage For Your Business

Being a business owner requires plenty of planning. Since even your most detailed plans can't predict global catastrophes or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like business continuity plans and extra liability. Fantastic coverage like this is why Indianapolis business owners choose State Farm insurance. State Farm agent Kyle Hale can help design a policy for the level of coverage you have in mind. If troubles find you, Kyle Hale can be there to help you file your claim and help your business life go right again.

Eager to explore the specific options that may be right for you and your small business? Simply reach out to State Farm agent Kyle Hale today!

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Kyle Hale

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.